Introduction

Understanding what’s going on in the private rented sector (PRS) helps landlords, tenants, and service providers make better decisions. Here’s a summary of the most recent data in England: how big the sector is, who is renting, how fast tenants move, and what the current supply, rent, and landlord trends look like.

Size & Demographics of the Private Rented Sector

- The private rented sector now comprises about 19% of all households in England, making it the second-largest tenure after home ownership. (GOV.UK)

- Between 2008-09 and 2023-24, the number of households in the PRS rose from about 3.1 million to 4.7 million, a 52% increase. (GOV.UK)

- Families are a growing cohort: in 2023-24 there were about 1.6 million households with dependent children in PRS (34% of PRS households). (GOV.UK)

Tenant Behaviour & Turnover

- Tenants in the PRS tend to move more frequently than those in social housing or owner-occupied homes, both within the PRS and between tenures. (GOV.UK)

- Mean age for private renters is approx. 41 years — younger than social renters (who average in the early 50s) and owner-occupiers. (GOV.UK)

Rents, Supply & Property Listings

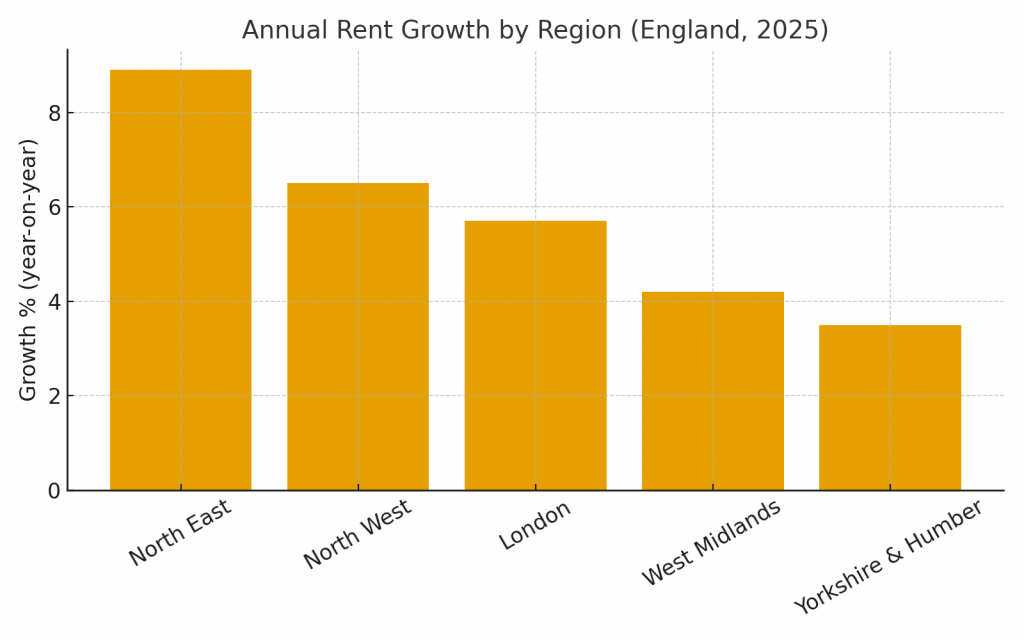

- Rent increases are still a concern: rents have risen substantially over recent years, especially in high-demand areas. Data from property listing sites shows variation: in London rents remain very high, whereas in many parts of England outside London, rental growth has slowed or dipped slightly in some quarters.

- Number of available rental properties (listings) is falling sharply. The landlord instructions index from RICS is deeply negative, indicating that fewer landlords are putting new properties up for rent.

Landlord Sentiment & Market Shifts

- Many landlords report concerns over the upcoming reforms, cost pressures (tax, interest rates, regulation), and risks. Some are considering reducing portfolios or leaving the sector.

- Mortgage interest relief and borrowing costs remain important variables. Buy-to-let mortgage rates have recently dropped to multi-year lows (three-year low) in some fixed-rate deals, providing some relief.

What to Watch Next

- How quickly the Renters’ Rights Bill becomes law in full, and how different provisions are phased in.

- How landlords respond — in pricing, in portfolio size, and in property quality.

- How supply and demand shift: whether fewer landlords lead to housing shortages, rent rises, and competitive markets.

- The effect of reforms on affordability for low-income renters and those on benefits.

Conclusion

The latest data show the PRS is larger than many might assume, with changing demographics, rising expectations, and a regulatory environment in flux. While rents remain a concern, especially in high-cost areas, there are early signs of supply tightening and landlord caution. For those involved in the sector, staying updated and agile will be critical in the coming months.